If 2020 has taught us anything, it’s that the future is unpredictable. Let’s be honest – how many of us could have predicted the absolute roller-coaster of a year we’re just about to exit? The age-old expression of ‘forewarned is forearmed’ has never been truer when it comes to financial planning.

While the next few months may be clouded by uncertainty for individuals and businesses alike, we can exercise as much control as possible to protect our assets. One way to do this is to invest in software to help us monitor our financial analytics. In this post, I’ll explain the best way to go about this!

What are financial analytics?

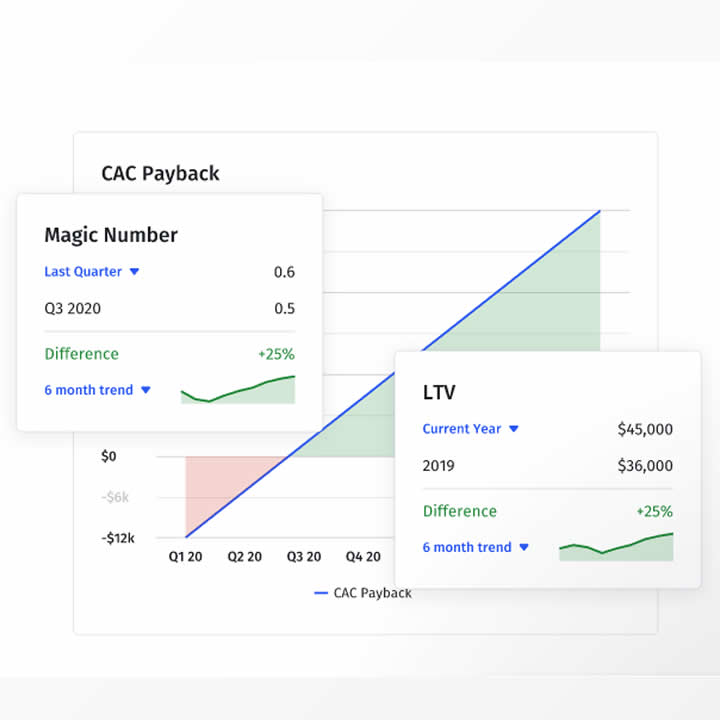

Financial analytics helps us to predict possible scenarios and events in our financial future. Doing this enables us to use fact-based data and insights to make strategic business choices. Essentially, financial analytics keeps track of recurring trends and numbers, allowing business owners to make informed decisions.

Where does software come into play?

Most businesses use software to manage their financial analysis needs. Having all the data in one place that’s easily accessible to whole departments is an excellent way to streamline processes. Most software platforms also have a host of other features integrated into their system that are very beneficial – such as automated reporting.

Essentially, if you’re using financial analytics, you need a decent program that’ll work as hard for you as you would for yourself. Forecasting isn’t something that most companies want to leave to chance, and understanding your top and bottom lines is crucial when making competent business decisions.

Here are three more reasons why you really can’t afford NOT to invest in this type of tool:

Business Models

Whether you’re looking for investors or negotiating a loan, you need a solid business model to present. This includes forecasts and projections for expenses and revenue, profit margins and real-time stats. A comprehensive analysis of your finances that is backed up by data (and model in a clear, understandable way) is crucial to securing the confidence of investors and lenders – no matter what your sector!

Streamlining

It’s no secret that process-driven tasks can eat up valuable hours of your time. Numbers are often the biggest culprit. Imagine being able to pull data from a single, regularly-updated source for tax returns, profit margins, and quarterly or annual reports. It also means that the data is right there for everyone to see (including executives and managers) – which helps avoid confusion and provides clarity when budget questions inevitably arise!

Forecasting

Wondering how far the budget can stretch to accommodate your next big project? Financial analytics software will be able to answer that question as factually as possible (though we may not always like the answer – am I right?). It combines its extensive data warehouse with AI-powered algorithms to show accurate projections for the future. No more haggling in the boardroom or arguing with Accounting (not that I’m suggesting you ever do these things)…

To sum it up:

Financial Analytics is key to managing your assets, predicting market variations, increasing profits, and understanding the overall performance of your business. Using software to achieve this is the quickest, most effective way to ensure you’re staying ahead of the competition.

If you’re ready to get started, I’d recommend checking out reputable software companies that offer a comprehensive, all-in-one toolkit (Mosaic are a great place to start). Get the ball rolling and start 2021 off with all of your financial ducks in a perfectly-synchronised row!