Mismanagement of financial cash flow causes 82% of U.S. companies to fail. Based on a survey of small business owners, these are frightening figures cited by U.S. Bank. How does cash flow work, and does it affect a company’s well-being?

If this question is burning in your pocket, read our three-minute guide. Below we’ll explain why cash flow is important and give you ready-to-use tips for improving your financial health.

How does Cash Flow work?

Let’s dive into the cash flow definition business. What’s cash flow? This is the sum of all transactions that go through your bank accounts. This includes profits from orders, business management costs, purchases, etc.

Unlike revenue, cash flow shows both gains and expenses. And the higher this figure is, the more successful the company is. The cash flow statement explanation includes several types of financial activity.

To remain stable and grow successfully, you should monitor and analyze the following processes:

- Operating activities. This is the sum of the company’s current income and expenses. It is generated by the activities of the business.

- Investing activities. These are cash flows associated with the sale or purchase of assets. These can be investments in the purchase of business premises, vehicles, patents, etc.

- Financing activities. These are activities associated with debt repayments and financing by investors.

Cash flow is also divided into negative and positive. Negative cash flow means that the expenses for a certain period are higher than the income. Conversely, positive cash flow is defined when your cash inflow is higher than your cash outflow.

Importance of Cash Flow For Your Wallet

What does cash flow mean in a business for sale? Effective financial management always starts with cash flow. If you don’t have enough cash to pay your bills, it affects the quality of your operational performance.

The constant mess of money flow management can lead to delayed orders, stagnation, and even bankruptcy.

Let’s talk about the importance of cash management. With the knowledge of the current balance sheet, revenues, and expenses, a business can confidently plan for growth and prepare for periods of downtime.

It also allows companies to choose suitable periods to invest and expand.

In addition, good cash flow has a positive effect on a company’s credit rating. And the more transactions that go through the balance sheet, the more likely the bank will trust you with a larger loan at a better rate.

If you need to start monitoring your cash flow, try using an online expense tracker.

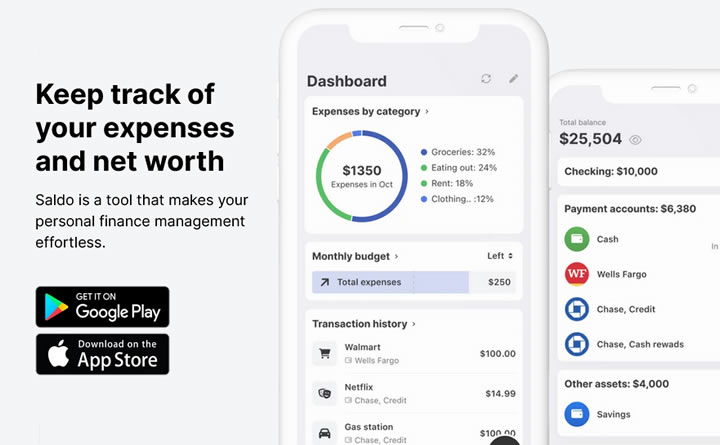

The perfect solution for freelancers and small businesses can be Saldo Finance. The tool automatically syncs with your bank accounts and analyzes expenses, profits, debts, and savings on one screen.

You can plan your budget and track spending by category. The app’s flexibility allows you to create custom categories and choose a spending limit for each of them or the whole budget. For convenience, the developers have also enabled both cash and accrual accounting.

Optionally, users can share the budget access with their colleagues or accountants.

Now you know the meaning of cash flow and why it is essential for entrepreneurs. Take advantage of your knowledge, and you’ll have no trouble getting your accounting in order.