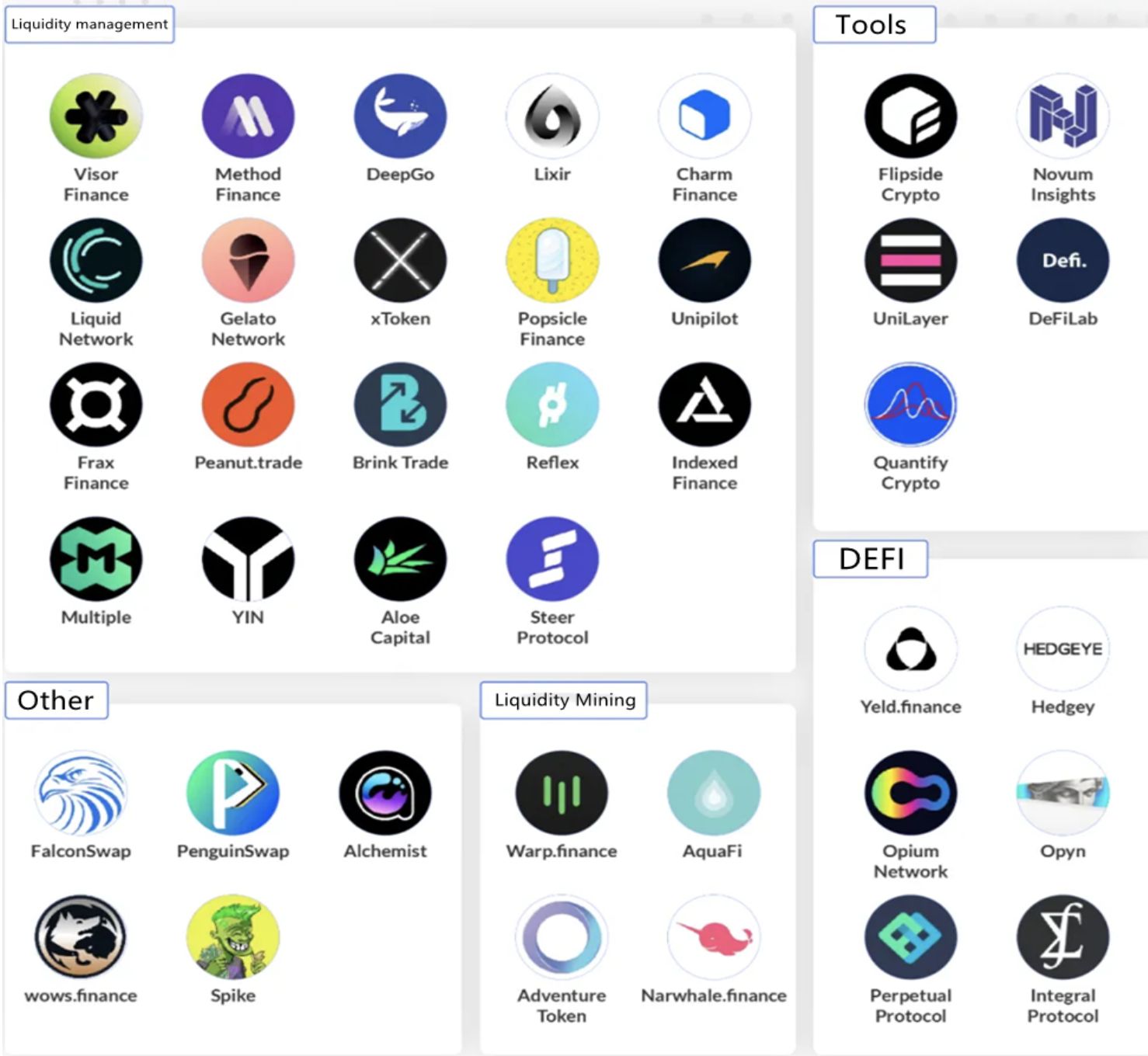

Uniswap V3, which has been online for only three months, has spawned different application ecology, spawning 43 projects in liquidity management, trading tools, liquidity mining, and other fields, most of which are concentrated in liquidity management.

In addition to the changes brought to users by the launch of the new version of Uniswap V3, the largest DeFi project in Ethernet Square has also spawned many new projects and brought new opportunities to other projects in this iteration.

Nearly three months after the launch of the Uniswap V3 version, and Uniswap V3 has also been deployed to the Ethernet Fong expansion networks Arbitrum and Optimism, it is time to take stock of which applications have injected power into the ecological construction.

Hayden Adams, the founder of Uniswap, previously tweeted to ask what projects will be built on Uniswap V3 or what projects will be built on Uniswap V3. According to the responses of various project parties, according to statistics, as of July 19, 2021, Uniswap V3 has multiplied many projects in liquidity management, trading tools, liquidity mining, and other fields, of which 21 are liquidity management applications.

It can be seen that the specific scope of Uniswap V3 custom liquidity gives each project more room to play.

The update of Uniswap V3 includes granularity control of aggregate liquidity, scope orders, multi-level rates, advanced prediction machine, etc., the new version gives users more autonomy, users can customize the liquidity range to achieve centralized liquidity and improve capital efficiency.

However, this also means higher requirements for liquidity providers, which leads to the emergence of new professional market-making institutions and proactive market-making strategies based on Uniswap V3.

For example, Lixir, Charm Alpha Vault, Visor, Method Finance, etc.

SheepDex, which launched on October 10th, is an official introduction: SheepDex (sheepdex.org) is a decentralized liquidity aggregation platform based on spot and derivatives on the BSC chain. Unlike other spot-focused decentralized exchanges, it is the first DeFi product to co-exist with spot and derivatives.

Participating in SheepDex can receive liquidity mining and trading incentives while allowing liquidity providers (LPs) to deploy funds in trading pairs at a certain price range, and reward transaction capital providers.

Thus improve the efficiency of the use of funds, further, focus on the depth of transactions, and provide better liquidity for end-users.

Promote the trading and clearing of derivatives. Among Sheepdex derivatives, perpetual contracts without capital rates are core innovations, and contract products such as leveraged tokens will continue to come online. Sheepdex aims to become a decentralized currency.

In a curious state of mind, I conducted an in-depth test.

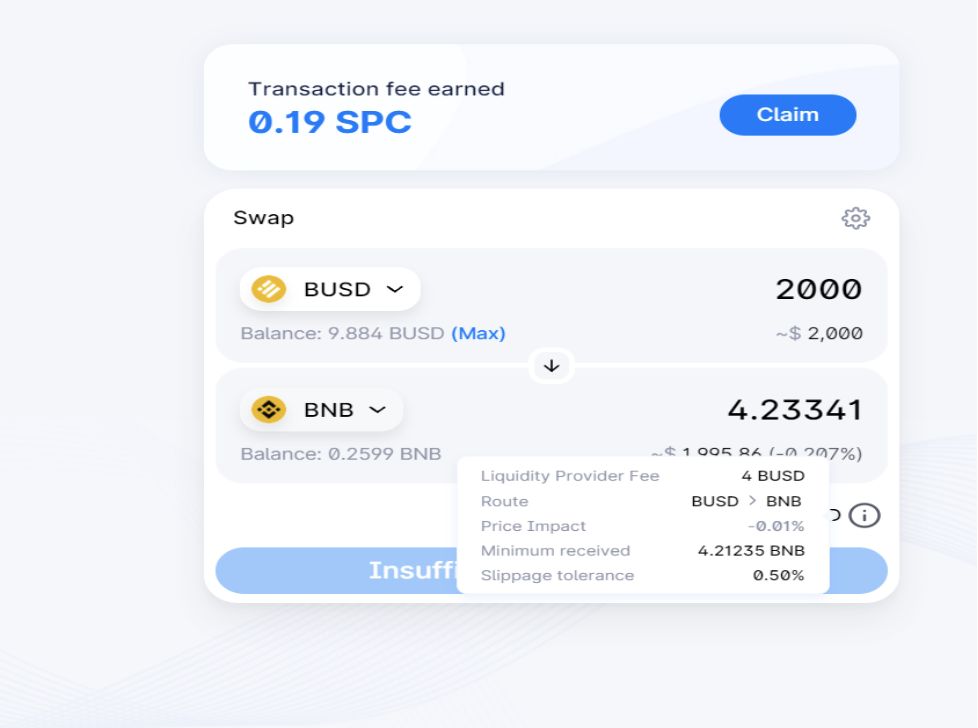

The first is the transaction, the volume of a 2000USDT transaction, the handling fee is about 4USDT, and the transaction reward is 3 SPC.

As can be seen from the chart below, the largest daily output is in the trading pair of BNB/SPC.

Since neither of the two currencies is stable, I will take BUSD/BNB as an example.

I set the BNB range to 447.51-469.51.

When the price of BNB is 447.51, my capital is BNB, and when the price of BNB is 469.51, my BNB will be changed to BUSD. If the currency price has been in the liquidity I provide, then I will always earn a handling fee.

The advantage of V3 is that it is up to you to decide your own funds. at this stage, Sheep is a V3 imitation disk on the BSC chain. Because UNI V3 is deployed on the ETH chain, the high GAS fee invisibly raises the threshold for participation, and retail investors basically do not have a chance to participate.

Sheep is the first V3 to be deployed on bsc, greatly lowering the barriers to participation.

After the approval of the security audit, it is believed that many organizations and market makers will take a share in it.

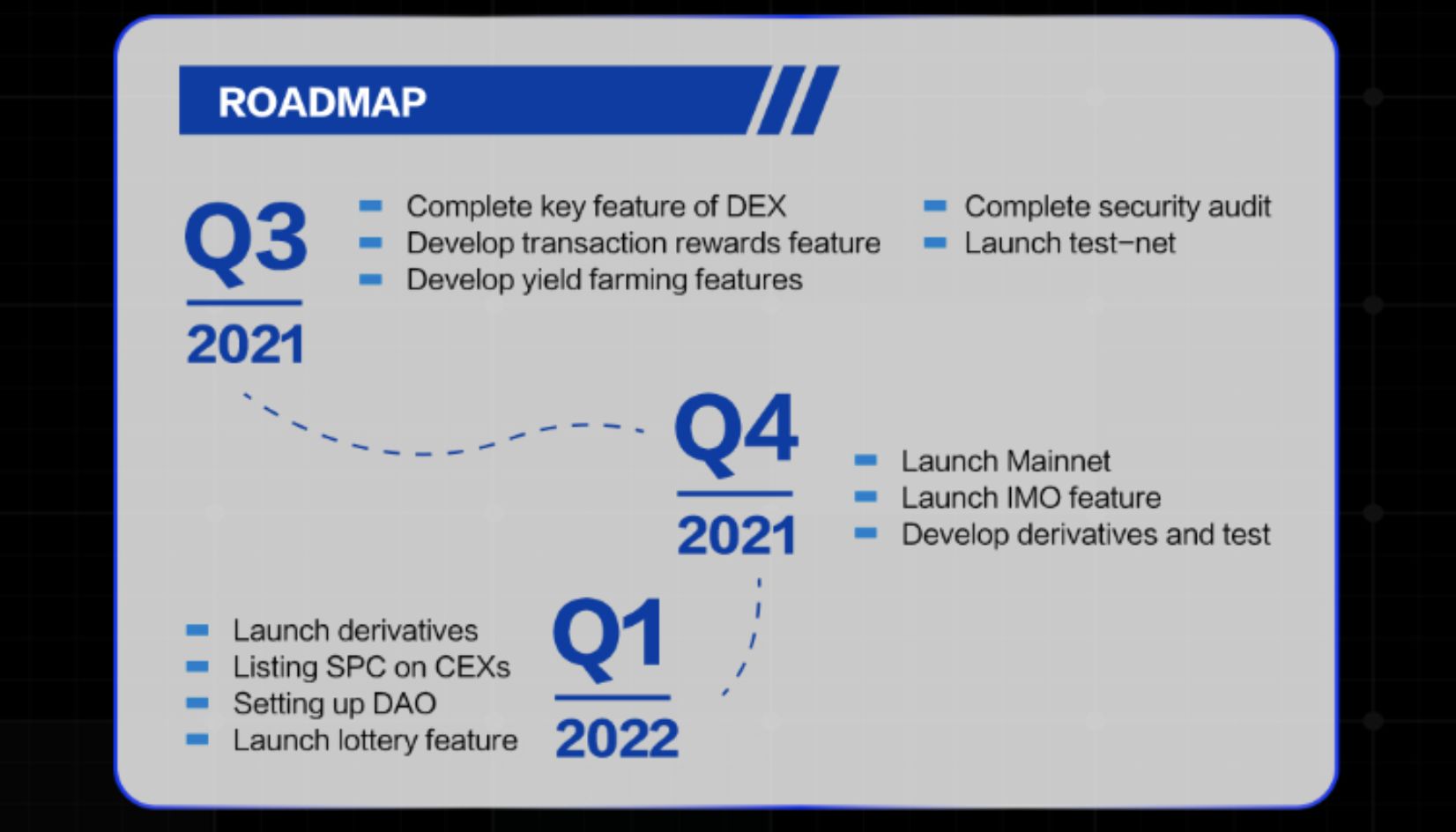

In its roadmap, derivatives tests are developed in the fourth quarter and launched in the first quarter of next year, and the most likely derivatives are option contracts.

Uniswap is the innovator in the DeFi wave from the beginning, and the V3 version also brings you a lot of new features, just like an experiment at the beginning, and the success of this experiment can be measured by ecological prosperity in addition to data.

Uniswap V3 not only gives users more choices and opportunities but also gives more project opportunities. In terms of liquidity management, users can choose to work with a variety of liquidity tools to create more games, or they can customize liquidity to create their own liquidity pool.

The innovation of V3 does not stop there but also includes that LP tokens are no longer the standard ERC 20 tokens but NFT, which brings DeFi and NFT together, allowing LP to set different and unique market-making terms.

The adoption of NFT allows V3 to sign and implement more complex financial activities than before and increases the flexibility of decentralized finance.

Uniswap V3 also provides prophecy services to other DeFi products and provides a wider range of services than V2.

Uniswap sets the option of multi-level fees, and compared to manually selecting fees each time it was first released, the recently updated function of Uniswap automatically selects fee levels for users, and the application now automatically defaults to the reasonable fee levels recommended by most LP policies, but LP can still manually select fee levels by clicking the “Edit” button to show the additional fee levels and their respective liquidity allocation percentages.

At present, there is not a DEX that integrates spot and derivatives in the DeFi industry, and through UNI V3, we can see that the market expectations and demand for derivatives are very high.

In a nutshell, SheepDex can be thought of as a Uni V3+ DYDX on BSC.

If more and more ecology enters SheepDex, can SheepDex become the next Defi leader?

***

SheepDex Website:https://sheepdex.org/

SheepDex Twitter: https://twitter.com/SheepDex

SheepDex Telegram: http://t.me/SheepDex