Just when you thought understanding cryptocurrency was as easy as deciphering hieroglyphics, along comes the concepts of Crypto CFD, Crypto Spot, and prop trading to add another layer of complexity.

You’re no stranger to the world of cryptocurrency, yet these specific trade types might be murky territory.

Crypto CFD, or Contract for Difference, offers you a chance to profit from price movements without owning the underlying asset, while Crypto Spot trading involves buying or selling a cryptocurrency for immediate delivery.

As you navigate this labyrinth, it’s crucial to understand the differences, benefits, and potential pitfalls of each. So, buckle up, because we’re about to embark on a fascinating journey into the heart of cryptocurrency trading.

Understanding Cryptocurrency Trading

Diving into the world of cryptocurrency trading, you’ll encounter two primary methods: Crypto CFD and Crypto Spot.

Both methods heavily rely on Blockchain Technology, a decentralized, public ledger where all cryptocurrency transactions get recorded. It’s the backbone of the crypto world, providing transparency and security that you can’t find in traditional banking systems.

But, let’s not get ahead of ourselves. Before you start trading, you need to understand Digital Wallet Security. This is where you’ll store your cryptocurrencies like a digital bank account.

It’s important to choose a secure digital wallet to protect your investments from hackers.

Crypto CFD, or Contract for Difference, is a method where you don’t own the actual cryptocurrency. Instead, you’re speculating on the price difference between the opening and closing trades. On the other hand, Crypto Spot is more straightforward.

You buy the cryptocurrency at its current price and own it outright. It’s then stored in your digital wallet until you decide to sell. Understanding these methods and the technology behind them is key to successful cryptocurrency trading.

So, arm yourself with knowledge and dive in!

Defining Crypto CFD Trading

Having grasped the overview of Crypto CFD and Crypto Spot, let’s now get a closer look at what Crypto CFD Trading entails.

Crypto CFD (Contract for Difference) trading is a derivative product that allows you to speculate on the value of cryptocurrencies without owning them directly. This provides a significant advantage as you can profit both from rising and falling market trends.

Crypto Leverage is an essential aspect of CFD trading.

It allows you to open a position larger than your initial investment, increasing your potential profits. However, it’s crucial to remember that leverage also magnifies CFD Risks as losses can exceed your initial deposit.

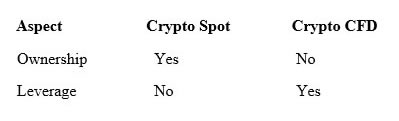

Here’s a simple table to illustrate:

Advantages and Disadvantages of Crypto CFD

Like any financial instrument, Crypto CFDs come with their own unique set of advantages and disadvantages that you need to understand before deciding to engage in this type of trading.

One of the main advantages of trading Crypto CFDs is the leverage benefits. This means you only need to deposit a fraction of the total trade value, allowing you to potentially make much larger profits from small price movements.

However, it’s important to note that while high leverage can magnify profits, it can also magnify losses, so it’s a double-edged sword.

Now, let’s talk about the CFD risks. Unlike owning the actual cryptocurrency, when you trade Crypto CFDs, you don’t own the underlying asset. This means you’re susceptible to price volatility and liquidity risks.

Additionally, the lack of ownership means you can’t benefit from certain perks like voting rights or dividends.

Moreover, Crypto CFDs are usually traded over the counter, which means they aren’t traded on a regulated exchange. This adds another layer of risk as it can lead to a lack of transparency in pricing and increased counterparty risk.

Therefore, while Crypto CFDs can offer significant opportunities, they also come with substantial risks. Make sure you understand these before diving in.

Spotlight on Crypto Spot Trading

Now that we’ve examined Crypto CFDs, let’s shift our focus to Crypto Spot trading, a different approach to cryptocurrency investment. With this method, you buy or sell cryptocurrencies instantly at the current price, or the ‘spot price’.

It’s a straightforward process that offers immediate ownership of the digital asset.

One factor you’ll need to consider in spot trading is the Spot Market Volatility. Unlike traditional assets, cryptocurrencies’ value can swing drastically in a short period. This volatility, while potentially risky, can also create opportunities for high returns.

It’s a double-edged sword, so it’s essential to be well-informed and strategic with your decisions.

As for Spot Trading Strategies, you have a few options.

‘Buy and hold’ is a common strategy where you buy a cryptocurrency and hold onto it, expecting its value to increase over time. ‘Day trading’ is another, where you aim to profit from short-term price fluctuations throughout the day.

It requires more time and attention but can yield quick returns if done correctly.

Comparing Crypto CFD and Crypto Spot

In understanding the differences between Crypto CFD and Crypto Spot, it’s crucial to consider the unique benefits and potential drawbacks each trading approach offers. Now, let’s dive into some of the key differences:

- Leverage Differences: In Crypto CFD, you’re allowed to trade on leverage, giving you the ability to open larger positions than your initial investment. However, with Crypto Spot, you can only buy or sell the actual coins at their current market price.

- Regulatory Comparisons: Crypto CFDs are regulated products, providing you with certain protections. On the other hand, Crypto Spot markets are generally unregulated, which can lead to greater risks.

- Ownership: With Crypto Spot, you own the cryptocurrency and can move it to any wallet. But with Crypto CFD, you’re merely speculating on price movements, not owning the actual currency.

- Trading Hours: Crypto Spot markets operate 24/7, allowing you to trade at any time. Conversely, Crypto CFD trading hours may be limited based on your broker’s schedule.

Considering these points can help you make an informed decision about which trading style suits your needs best.

Frequently Asked Questions

How Do Tax Implications Differ Between Crypto CFD and Crypto Spot Trading?

You’ll find tax implications vary. Crypto CFDs might increase your risk of tax evasion consequences. Crypto taxation laws also differ for spot trading, potentially offering more flexibility. Always consult a tax professional for advice.

What Are the Primary Factors Influencing the Choice Between Crypto CFD and Crypto Spot for Beginner Traders?

As a beginner, your choice hinges on factors like risk tolerance, investment goals, and market understanding. Use a ‘Trading Platforms Comparison’ and a ‘Beginner’s Guide to Crypto’ to make an informed decision.

What Are the Risk Management Strategies to Consider in Both Crypto CFD and Crypto Spot Trading?

In managing risks, you should consider leverage utilization; don’t overuse it. Also, adopt a diversification strategy, spreading investments across different assets to reduce vulnerability to market volatility. Always review your strategies regularly.

Can I Switch From Crypto CFD Trading to Crypto Spot Trading at Any Point, and Vice Versa?

Yes, you can switch between trading platforms at any point. However, you’ll need to consider the leverage differences and the specific rules of each platform before making the switch.

How Do Global Market Events Affect the Trends in Crypto CFD and Crypto Spot Trading?

Global market events greatly impact your trading trends. Market volatility and global economic indicators can cause changes in your decisions, as they influence the values of your assets in both crypto CFD and spot trading.

Conclusion

In the end, it’s your call. Crypto CFD trading offers leverage and access to global markets but comes with high risk. On the other hand, crypto spot trading is straightforward and transparent but lacks leverage.

It’s crucial to understand your financial goals and risk tolerance before making a choice. Whatever you choose, remember, that there’s no shortcut to success in trading. So, research well, stay updated, and trade wisely.