In today’s fast-paced world, credit has become an indispensable tool for financial transactions. Credit is crucial for realizing our financial goals, from buying a house to funding a business venture.

When it comes to financing, most people think of “loans.” But there are many different types of loans available for different situations and needs. Two popular loan options are lines of credit and personal loans.

Both can be great options depending on your individual needs and goals, but it’s essential to understand their differences to make an informed decision. Let’s explore the key features, pros, and cons of the line of credit and personal loans.

Line of Credit

A line of credit is a flexible borrowing option that allows you to access funds as needed. It is a pre-approved credit facility that you can draw from as and when required, up to a certain limit. The interest is charged only on the amount you use and not the entire credit limit.

Lines of credit usually have variable interest rates and require monthly payments (just like any other loan). Once approved for a line of credit, you can withdraw funds up to the limit the lender sets.

Interest is only charged on the amount you borrow, not the entire credit limit. You can repay the borrowed amount in whole or in installments, and once the balance is paid off, you can borrow again up to the credit limit.

Types of the line of credit

There are two main types of lines of credit:

- A secured line of credit: It is backed by collateral, such as a home or a car, which the lender, in case of default, can seize.

- An unsecured line of credit: They do not require collateral, but the interest rates are typically higher.

Personal Loans

A personal loan is a fixed amount of money borrowed from a lender repaid over a fixed term with interest. It is typically an unsecured loan, meaning it does not require collateral

Once approved for a personal loan, you receive a lump sum of money, which you can use for any purpose. You then repay the loan with interest over a fixed term, typically between one and four years.

Types of personal loan

Several types of personal loans include secured and unsecured personal loans, debt consolidation loans, and payday loans.

- Secured personal loans require collateral, while unsecured personal loans do not.

- Debt consolidation loans are used to consolidate multiple debts into one.

- Payday loans are short-term loans that come with high-interest rates.

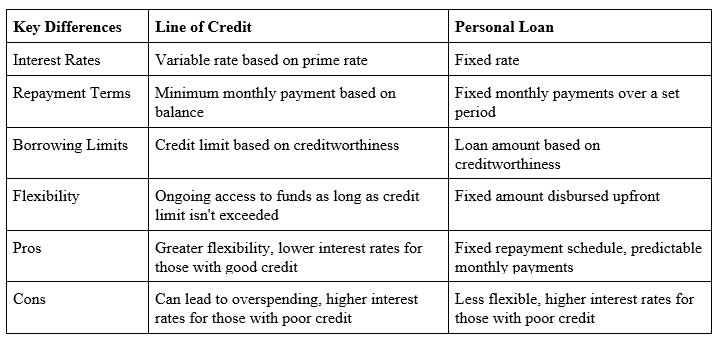

Differences between Line of Credit and Personal Loan

How to Choose Between a Line of Credit and a Personal Loan?

Consideration of personal financial goals: A personal loan may be a better option if you need a lump sum of money for a specific purpose. If, however, you need ongoing access to funds for expenses that arise over time, a line of credit is more suitable.

Comparison of terms and conditions: It is essential always carefully to compare all the terms and conditions of a line of credit and a personal loan before deciding.

Evaluation of risks and benefits: While a line of credit offers greater flexibility and ongoing access to funds, it can also be more challenging to manage and lead to overspending.

Personal loans provide a fixed amount of money with a fixed repayment term, making it easier to budget and plan for repayment.

Conclusion

The bottom line is that both lines of credit and personal loans offer unique advantages depending on your situation—it just depends on what kind of flexibility or stability you’re looking for in financing your purchase or project.

It’s essential to research before taking out either type of loan to understand all the details to avoid any surprises.

With a clear understanding of how these two loan types work differently, you can make an informed decision about which option best meets your financial goals. If looking for instant funds, apply for an instant personal loan with IndusInd Bank today!