Based on the idea that financial education is crucial when planning for the future, Aging IQ was generated to help adults best adapt and plan for what is to come based on a series of metrics we provide.

The future of each person is dependent on a number of factors, like health, financial standing, and family history, just to name a few.

Aging IQ uses proprietary metrics that provide numerical results to prompt the discussion for a change in future financial planning, while also offering suggestions that can improve the longevity of your mental, financial, and physical health.

These proprietary metrics include MyLifeScore, MyTrueAge, and Policy Value IQ.

MyLifeScore is a proprietary metric that considers not only how old you are and how long your estimated lifespan is, but most importantly, how much of your lifespan will be spent in good health—your healthspan.

This measure combines biological, demographical, and social trends to generate a unique score that depicts where you currently stand in your later years relative to others in your age group, while also offering suggestions for what you can do to improve your MyLifeScore metric.

The results you produce by utilizing the MyLifeScore metric provide you with knowledge on what you should financially plan for in the future, and how changing your lifestyle could either improve or worsen your physical, mental, and financial future.

Knowing your MyLifeScore can improve the accuracy of your financial and lifestyle retirement projections. Aging IQ’s estimates are generated by AI-based data-driven technology powered by Longevity Market Assets and Lapetus Solutions.

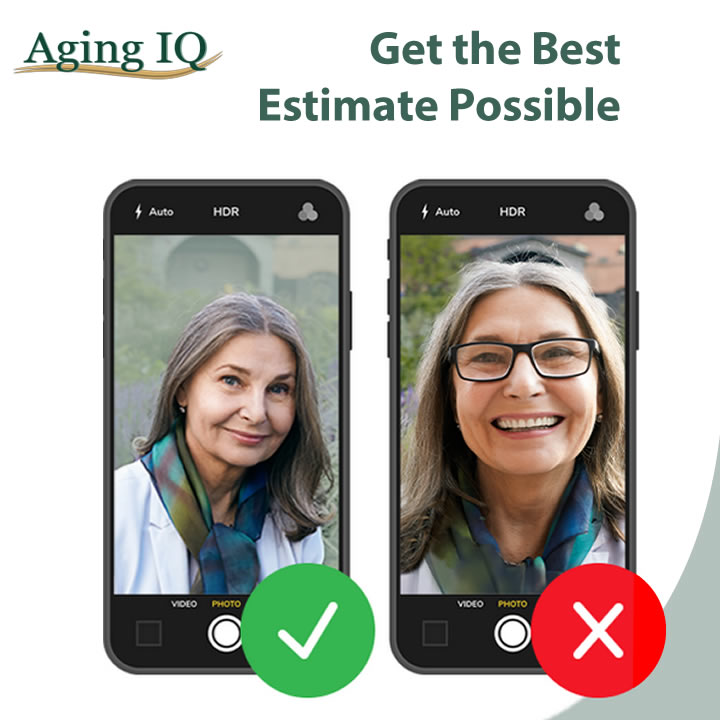

MyTrueAge is another metric offered at Aging IQ that extracts data from a photo of a person’s face, along with a few key demographics, to generate feedback to help them best plan for their future.

The definition of a person’s chronological age is how many years, or how much time, they have been on earth. A person’s biological age is defined as how fast that person has aged while on earth, based on our results generated by MyTrueAge.

These estimates are also generated using AI-based data-driven technology powered by Longevity Market Assets and Lapetus Solutions. The Policy Value IQ Calculator is a planning metric that Aging IQ offers to help with financial longevity.

Sponsored by Abacus Life Settlements, Policy Value IQ gives you the knowledge you need to make an informed decision about your life insurance policy; you can see how much your “life” is worth in just seconds!

All you have to do is simply input your name, email, phone number, gender, age, life insurance policy amount, and policy type, and rate your overall current health standing, to see how much your life insurance policy is worth today.

With this, our goal is to be the guide between the results you produce today and the change for your tomorrow.

You can reach out to the site support team to learn more about the aforementioned metrics, or simply inquire about other suggestions that would improve your longevity.

Aging IQ’s top priority is to revolutionize the power of future planning by making the needed steps today to increase financial, mental, and physical longevity.