Nowadays, every business needs a system for processing payroll even including small businesses. With more than one employee on board, it becomes quite indispensable to have a system that tracks and calculates payroll expenses: your cumulative year-to-date (YTD).

Year-to-date payroll

The term year to date refers to the period starting from the beginning of the first day (calendar or fiscal year) continuing up to the current date.

For permanent employees, YTD Payroll costs are calculated by each employee’s gross income and not their net income. Gross income meanwhile, is the amount of money an employee earns before subtracting deductions and taxes.

Some scenarios would also demand you to include the amount of money paid to independent contractors or freelancers. Here, independent contractors wouldn’t be your employees, they are self-employed who are hired for a specific task, but they will be included in your YTD.

For Instance

Your car’s odometer will be used to determine the distance traveled since the beginning of a certain period (when the car came out of the manufacturing factory). Similarly, YTD constitutes the number of days since the beginning of a certain period (either the calendar year or the fiscal year).

How to calculate Year-to-date?

Calculating YTD consists of two different options, you can either calculate it from the beginning of the calendar year i.e. 1 January which is considered as a common practice. This means that the accounting books will close on 31 December.

Companies have a free right to start their financial year at any point. Though, a lot of organizations have fiscal years starting from 1 April, those who are not bound by the traditional accounting year.

Ex

YTD revenue of Company ABC Ltd. (whose financial year ends on 31 March 2019) is Rs 200 crore, as of 30 November 2019. This means that the company earned Rs 200 crore of revenue during the period of 1 April 2019 to 30 November 2019 i.e. during the 8 months.

Mostly, companies (with a financial year in March ending) list their YTD numbers as of 30 September 2019 i.e. publishing their half-yearly figures. This gives out financial figures for the first six months of the financial year.

Comparing current YTD results with previous year’s YTD results of the same period, analyses the current performance of the company comparing that to the previous period.

Why does Year-to-date Payroll matter?

- Year to date payroll gives you a clear view as to compare the payroll expenses of your employees and the yearly budget which was allocated for these costs. By having these costs in front, you can determine the amount used for payroll and the total expenses incurred – this will be useful for controlling the costs if they are exceeding your budget.

- The YTD monetary worth on the paystub gives the employers a vision of how much they have incurred on a monthly, quarterly, and yearly basis.

- Payroll YTD is a crucial aspect when you are filling out the employee Form W-2s. Similarly, to get an accurate Form W-2, you have to be aware of the exact payout of every employee.

- Not only does it help you with managing tax slips, through YTD payroll – you can determine or predict your tax liability. After determining quarterly and yearly tax liabilities, managing purchases and your overall available funds will become an effortless job.

Businesses generally would prefer checking on their finances throughout the year to determine the pathways and roadblocks which can occur in achieving their short-term and long-term goals.

Similarly, many small businesses use year-to-date information to perform a mid-year financial analysis which presents a valuable approach to determine its progress by looking at the financial decisions taken over the last six months.

Pay stubs and YTD Payroll

Employees can track their YTD Payroll earnings through their paychecks. The company has to make sure to not forget to hand out the pay stubs every time they pay the employees.

The pay stub will make the employees aware of the wages they earned during the pay period and year-to-date. This includes gross wages, deductions, and taxes charged.

These details can be beneficial to let the employees know about the amount of money they could owe to the IRS, before the filling. This way employees can choose to claim lesser withholding allowances on Form W-4 after having the year-to-date earnings data showing what they owe.

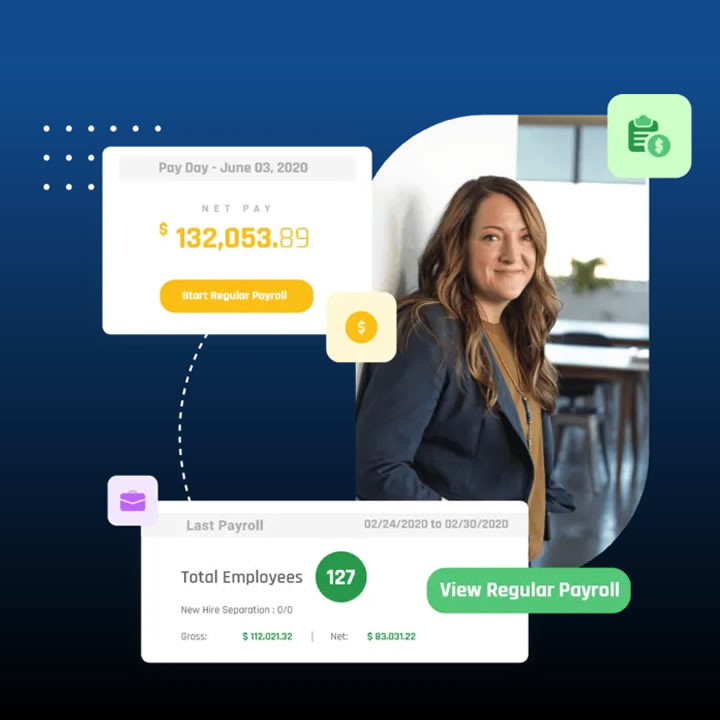

Still, find Payroll confusing? If you’re looking for help with managing your year-to-date payroll, head on to UZIO, offering an easy to use interface with their all-in-one Payroll software, aiding you to run your payroll and determine YTD smoothly. Check them out today!