PayDo – a payment system that provides financial services and online money transfers.

When clients create a PayDo wallet, they receive the same international bank account as all accounts in the countries of the European Union, as well as countries: Norway, Switzerland, and Liechtenstein. In this way, you can simplify and increase the speed of processing payments sent abroad. Your IBAN identifies the country to which the account belongs.

What Is PayDo?

IBAN from PayDo is an alternative to traditional bank accounts. Clients provide themselves with a digital approach to all banking operations, as well as increase their efficiency.

You can easily manage your account remotely from anywhere in the world and enjoy the benefits of a European bank account. And for this, it is not necessary to create a separate European legal entity.

When you use a PayDo account, you make it easier for yourself to manage your funds and reduce commission like a bogus.

As expected for a digital wallet, you can store funds, send or receive payments, as well as exchange money inside your account, also completely remotely and without being tied to business hours.

Smart algorithms, in the absence of a supported currency, convert the payment amount into the currency that is available for disposition. The conversion takes place at the rate of the issuing bank.

To get an IBAN in PayDo, you do not need to bother much.

You apply for a bank account immediately after requesting its verification. Further, you do nothing more than fill out a short form, where you indicate information about what you do or what your company does (it all depends on the type of account you open).

You also indicate what location the counterparties have (transfers incoming or outgoing)

How Does PayDo Work?

You submit a request to receive your European details after your account has been verified. You will be asked to fill out a short form where you provide details about your activities or the activities of your personal company.

You must also indicate where the counterparties are located.

Clients receive EU IBAN details to make payments in euro currency or pounds sterling for individuals or legal entities. To open an account, you do not need anything more than a smartphone and access to the Internet.

You can manage your personal or business payments remotely and enjoy all the benefits of SEPA/SWIFT or TARGET2.

PayDo offers for a client business in the EU the opening of a merchant account, where you can make payments using standard and alternative methods. They also offer support for international acquiring.

PayDo also has technical support on PayDo website, which is ready to help customers in any situation.

Is PayDo Legit?

It is worth taking into account that there is a certain list of countries with which PayDo does not cooperate. Those customers or businesses whose actual address is located in such countries cannot use the payment system:

- In countries that have been subject to sanctions or embargoes, as well as similar measures that have been applied by the UN or the Task Force that deals with money laundering problems;

- In countries where, according to sources, there are no laws or regulations that prevent money laundering or financing terrorism;

- In countries where the level of corruption is high or where other illegal activities take place.

- In countries where residents create an organizational/financial burden due to a complex or specific legal or tax system.

If you are looking for an alternative to standard banking in any country then UK PayDo is a great choice for any business or individual. With this all-in-one solution, you can send and receive SWIFT/SEPA money transfers, as well as fund your account and make payouts.

There is also no problem with P2P payments and currency exchange within your account.

Is PayDo Safe to Make Money Transfers?

One of the main PayDo benefits – is an easy way to create a bank transfer, which makes it a really good way to do it, as PayDo offers to open a bank account online Europe from any corner of the world!

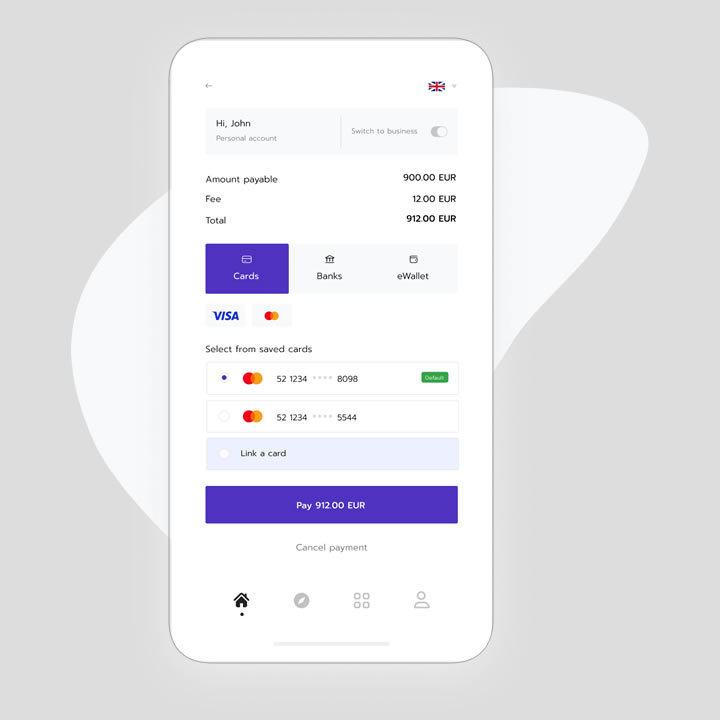

The first thing you need to do is go to the special “Create Translation” section that you’ll put on the left main menu. There you will click on the Bank transfer section.

The next step is to fill in all the information about the recipient and his account and his banking information. You do not need to enter the bank address, because it is automatically identified by the SWIFT code.

When you make a payment, make sure you are using the correct IBAN. Accordingly, if there is some kind of error in the data, then some other person will receive your transfer, and you will be charged a commission for this transaction in any case.

Next, you fill in the “Purpose of payment” field, where you specify in detail the description of the goods for which you pay or for services. You indicate the number and date of the document, which is the basis for this operation.

When it comes to commercial payments, you need to enter the number and date of such documents as, example, an invoice, an invoice, a shipping document, and the like. Also, do not forget that you still need to add a detailed description of the product or service.

You can indicate in the corresponding field that your payment is not commercial.

After that, you can upload documents that confirm that you have made the payment and indicate the amount of the transfer. You always need to check your details once again, as well as the amount on each open page.

The payment that has already been sent cannot be changed.

After these steps, the payment must be confirmed by two-factor authentication, after which the funds will be debited from your account and will be further processed.

On average, your payment will be processed within 2 or 3 business days (in some cases it can take up to 7 business days). You can always ask additional questions about your translation.

In the payment history, each sent transfer will be saved and you can check your outgoing bank transfers with PayDo review in the “List of transfers” section in the main menu. With PayDo money transfers are really easy.