Are you planning to start a business in the United States?

If so, you’re not alone. Nearly 1.35 million business applications were filed in the first quarter of 2021. This marked a jump of nearly 61% YoY. This increase in the number of applications points to the fact that many people are now trying their hands at making it big as an entrepreneur.

So, if you’ve started on the path of entrepreneurship, then it’s likely that you’ll have to face a lot of challenges along the way.

What are these challenges?

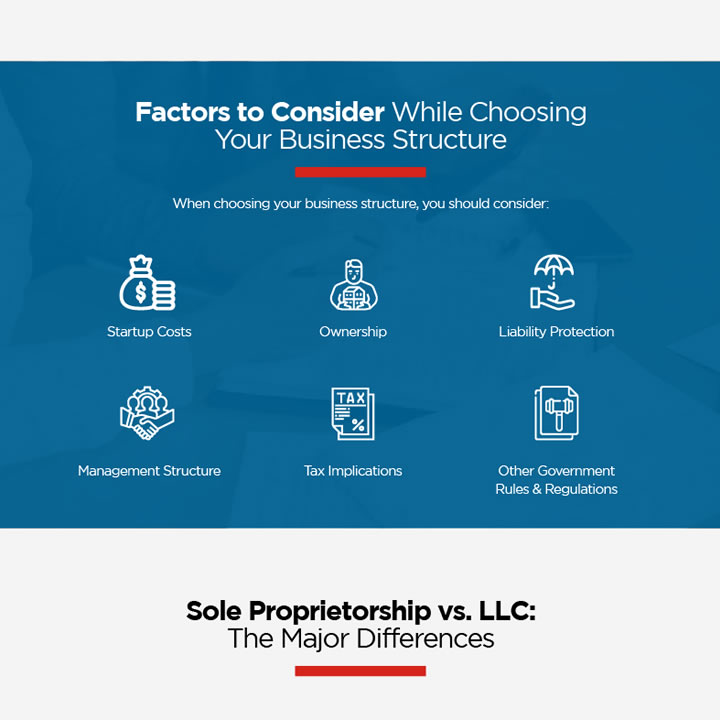

These include the likes of finding funding for the business, hiring employees, looking for n office space, and so much more. You will also have to decide on a business structure to form the company.

In this post, we’ll examine how the structures of Sole Proprietorship and LLC (Limited Liability Company) are different from each other.

Who Can Own the Business?

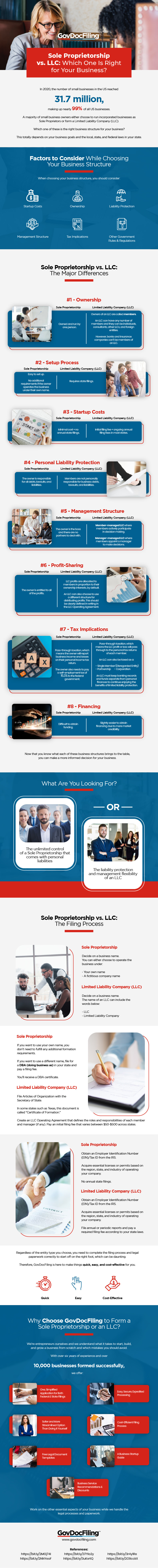

One of the prime differences between Sole Proprietorship and LLCs is their ownership structure. If you’re looking to have partners in your business, you won’t be able to opt for Sole Proprietorships as they allow only a single owner.

LLCs can have multiple owners, called members. Also, these members don’t necessarily have to be other individuals. They can be foreign companies or even other LLCs.

How Would the Business Be Taxed?

You also need to consider business taxation when you’re choosing a business structure. When you own a Sole Proprietorship firm or an LLC, you’re subject to paying self-employment taxes. This is because the firm’s income would flow through to you.

While there’s no way of avoiding this in Sole Proprietorships, you can do so in LLCs. You can get the LLC taxed as an S-Corporation and then pay corporate taxes for the LLC instead. Self-employment tax won’t be applicable to you as you’d be treated as an employee of the company.

Starting the Business

The process for establishing the business varies with the company structure. Sole Proprietorships are easy to set up. You can start running them under your name with ease. However, the same can’t be said for LLCs.

The process for setting them up is slightly more elaborate. You’ll have to file your Articles of Organization with the Secretary of State. Additionally, you’ll be required to create an Operating Agreement and also pay the state filing fees.

The similarities and differences, however, don’t stop here. There’s a lot more that you must know about LLCs and Sole Proprietorships. To learn all about them, you can check out this infographic created by GovDocFiling.

Author bio:

Brett Shapiro is a co-owner of GovDocFiling. He had an entrepreneurial spirit since he was young. He started GovDocFiling, a simple resource center that takes care of the mundane, yet critical, formation documentation for any new business entity.