You’ve probably read stories of people making small (and sometimes big) fortunes by speculating on the stock market. You may not have read so much about many more people losing money buying and selling shares. But the truth is most people will not make a profit because they fail to do their homework or follow a sound investment strategy.

In this guide, we give some solid advice for would-be investors in South Africa, which will help them get off to the best possible start. But first, one important question needs answering.

What is a share?

A share is an equal slice of the current value of a company. For example, if the company is worth $50 million and there are 100 million shares in circulation, each share’s value is $0.50.

Market forces will then dictate the price of each share. So, if the company does well, more people will wish to own a share, and the demand will increase the price. But if the company does badly, then people will look to sell their shares, meaning the price comes down.

When you look at how to buy shares in South African stocks like Capitec Bank or Vodacom Group, there are two very different approaches. Firstly, you can buy a number of actual shares in the company, which means you own a proportion of it and can receive dividend payments if the business declares a dividend from its profits. The second, increasingly common way is to trade on the movements of the share price. This is spread betting – you do not own the share but can profit (or lose) as the price rises and falls.

Find a top broker

You can’t deal in shares without a broker. This is the institution that will process your trade orders (called executions) and where you keep your account and records of all transactions.

But one broker might be very different from another. Fortunately, in South Africa, there is a broad choice of excellent brokers to choose from. Many are internationally renowned and offer all the key things that a novice investor needs:

- Safety and security – this is the prime concern, making sure your broker is above board and that your money and personal data is safe

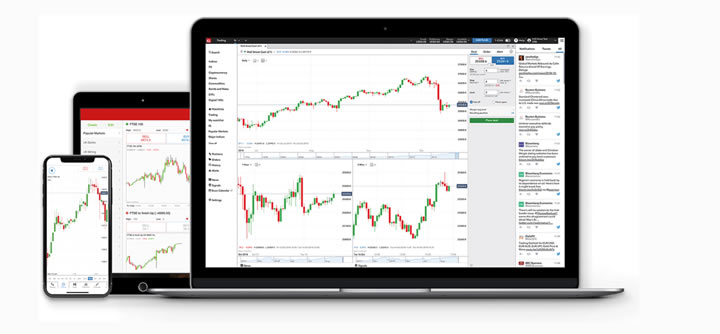

- Fast trading – when you come to a trading decision, you want to do it fast before the price moves. A broker with an app is ideal because it means you can trade on your mobile device anytime and any place.

- Choice – beginners are advised to try mainstream stocks first. These are easier to follow and understand. But over time, you might like the choice of trading on commodities like gold, or the futures market on grain prices, or even on the overall price of the Johannesburg Stock Exchange All Share Index. You can also trade on currency movements.

- Payment methods – the ability for customers to deposit or withdraw their funds fast and with a variety of payment methods

- Support – good customer service is key, especially for new investors who may need help. Find a broker with good live support.

Follow expert advice, to begin with

Once you have found a broker, set up your trading account, and deposited some cash, do not go rushing into your first trade, no matter how tempting it may be. Instead, take time to read up on what the experts are saying.

New traders can find key advice and share tips from many sources, including the media and specialty trading services. Don’t go out on a limb, to begin with. Instead, perhaps buy a mainstream stock that several analysts are backing. It’s a safer route, and once you get used to how everything works, you can begin to test out the predictions of others.

Only once you have built up your own knowledge and strategies should you consider buying shares solely using your own research.

Study – and keep on studying

Just like all other subjects and every sport, if you want to get good at buying shares in South Africa, you have to put in the hard miles. That means reading up, studying company accounts, looking at share price charts, and learning new trading strategies.

Good traders will never stop reading up and learning. The moment they do is the time they risk losing. You can find many courses online, some of them free, which will help put you on the right path to trading success.

As the rock band Oasis sang, little by little is the best approach. Don’t jump in unprepared, and you might find you can begin to make a slow and steady profit. Far better than making a rapid loss.