Standard and Poor’s 500 Index, aka the S&P 500, is one of the most influential stock market indices reflecting the value of the 500 largest companies in the United States.

Investors use this index to assess the state of the stock market and make informed decisions about buying or selling shares.

Established in 1957, the S&P 500 index encompasses stocks of companies with significant capitalization, leading in their respective industries. The index is calculated based on the company’s financial indicators, such as profit, dividends, market capitalization, etc.

A rise in the index indicates a favorable condition of the US stock market, allowing investors to anticipate an increase in stock prices. Conversely, a decline in the index may indicate economic challenges.

In October 2022, the S&P 500 index experienced a decline amid investor concerns about a potential recession in the US economy. These concerns were related to various factors, including the Fed’s decision to raise interest rates, increasing inflation, and uncertainty in the labor market.

However, a month later, the S&P 500 index reached its historical maximum, exceeding the 4,500-point mark. This increase was attributed to rising oil and commodity prices.

Most recently, on June 15, 2023, the index reached 4,425 points, followed by a downturn.

The recent rate hike by the Federal Reserve and the growth of the US market has made stocks significantly less attractive. The expected yield on stocks, which are considered high-risk assets, equaled the yield on three-month US Treasury bonds.

Although the Federal Reserve kept the rate unchanged at 5-5.25%, the regulator made it clear that the rate may continue to grow in the future, and any reduction is not expected until at least 2024.

Forecasts suggest that the S&P 500 index offers similar profitability over a 12-month horizon.

Since January, the expected annual return of the index has increased by 15%, making the first half of 2023 one of the strongest in the past two decades. Nevertheless, the precise yield on high-risk stocks and safer bonds may indicate the end of the bullish phase in the stock market.

To gain a comprehensive understanding of market sentiment, let’s examine the top 5 stocks in the S&P 500 index.

NASDAQ:AAPL (3.027T USD): Apple Inc. is experiencing active development, with the value of its shares on the rise and no apparent factors that could impede its growth.

NASDAQ:MSFT (2.513T USD): Microsoft Corporation is another company that has updated its all-time high with a share price of $348.

The market excitement surrounding artificial intelligence has propelled the shares of AI-related technology companies, including Microsoft stock. Its prospects for continued growth are favorable.

NASDAQ:GOOG (1.526T USD): Alphabet Inc. (aka Google) is recovering after the global market decline at the end of 2022. And just like Microsoft, Google has a keen interest in AI.

Opinions on new technologies and the hype surrounding them vary, with some considering it another bubble and others viewing it as a further step in electronics development. But anyway, Google is a tech giant of the highest echelon and the right place to make a profit.

NASDAQ:AMZN (1.336T USD): Amazon stock price shows a noticeable and stable upward movement.

This trend appears to have sufficient momentum, and no significant fundamental issues are anticipated. The blocked merger with Activision Blizzard (NASDAQ:ATVI) worth $69 billion has not affected the stock price, and the hearings on this matter continue.

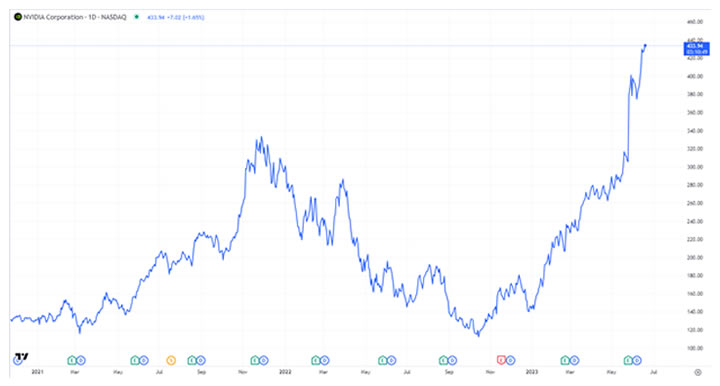

NASDAQ:NVDA (1.048T USD): NVIDIA Corporation has recently joined the prestigious “Trillion Club” and become one of the most notable companies of this year. This company is also engaged in the technology race driven by AI and strives to leverage this trend for maximum benefit.

Considering all these factors, many experts believe that the S&P 500 may sustain its growth in the coming months, provided that the economic situation in the USA remains stable.