An installment Loan (as defined by Investopedia) is a type of personal and business loan that is repaid with fixed scheduled payments or installments.

Installment loans can be granted online and in a store, they can be available for bad and good credit, secured by collateral and unsecured, with and without credit checks.

According to Ahrefs.com, the most popular google search queries on installment loans are:

- installment loans: 41000 (volume)

- installment loans online: 14000 (volume)

- installment loans for bad credit: 9900 (volume)

- online installment loans: 7900 (volume)

- installment loans near me: 5000 (volume)

- guaranteed installment loans for bad credit: 4900 (volume)

- online installment loans instant approval: 4200 (volume)

- guaranteed installment loans for bad credit direct lenders only: 4100 (volume)

- guaranteed installment loans for bad credit no credit check: 2800 (volume)

- no credit check installment loans: 2500 (volume)

- bad credit installment loans: 2500 (volume)

- tribal installment loans direct lenders no credit check: 2100 (volume)

- installment loans no credit check: 1900 (volume)

What conclusions we can make:

- It means most borrowers need an Installment Loan for bad (poor) credit scores.

- Online installment loans attract more customers than in-store services.

- Availability for bad credit is more essential for applicants than no credit check option.

- Firstly, Americans look for installment loans from state direct lenders, and only in case of their failure do they turn to tribal (Indian) lenders.

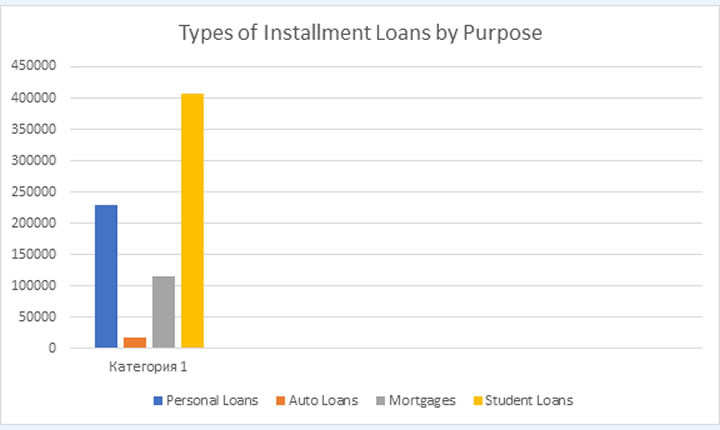

Types of Installment Loans by Purpose

If we go back to the definition of Installment Loans, we see that these are all types of credit that are paid off in scheduled installments. Thus, we can distinguish the following types of them:

- Personal Loans

- Auto Loans

- Mortgages

- Student Loans

The main criteria differentiating the loans above is their purpose of usage. While personal installment loans can be used for any needs, auto loans serve as financing for a car purchase, mortgages – to buy a house, and student loans – to pay for education.

Let’s check which of them attracts more customers:

Consequently, the most popular installment loans are:

- Student Loans (406K queries a month)

- Personal Loans (230K hits a month)

- Mortgage Loans (115K)

- Auto Loans (18K)

The reason for a Personal Installment Loan’s popularity lies in their universal usage opportunities – you can use them for any personal needs let it be home redecoration, car repair, medical costs, dental costs, etc.

You don’t have to report to the lender why you borrow this money.

Bad Credit Installment Loans vs Installment Loans for Good Credit

An average monthly number of searches for “Installment Loans for Bad Credit” over the latest 12 months is 9.9K while hardly anyone is looking for a good credit loan. What your credit score influences are the interest rate and the approval chances.

Though most lenders guarantee instant installment loan approval even to bad credit borrowers, it doesn’t mean they will offer similar rates and terms. The higher your score is the lower the finance charges you can expect as well as better terms and conditions.

Average Interest Rates for Various Types of Installment Loans

- Personal Installment Loans – 5.40% – 35.99%

- Auto Loans – 1.90% – 9.49%

- Mortgage – 5.28% on average

- Student Loans – 4.60% – 7.20%

For every type of installment, your credit score can affect the interest rates – the cheapest loans are offered only to those with good or excellent credit.

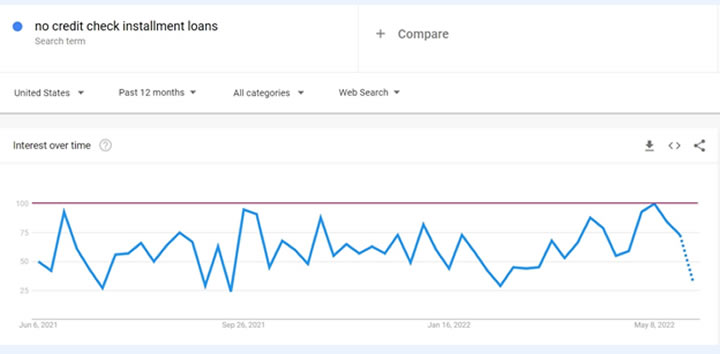

Who is Looking for Installment Loans with No Credit Check?

No credit check installment loans are those offered by lenders without a hard credit inquiry from any of the major credit bureaus. They have always been rather popular as provide guaranteed instant approval and quick financing on the same day.

Let’s look at the google trends on “No credit check installment loans” over the last 12 months:

Though the popularity of installment loans with no credit check can change from time to time, they are mostly in high demand among Americans. It is explained by the following reasons:

- It’s really fast and easy to apply for an installment loan with no credit check – you don’t need good credit, there’s no faxing, no paperwork;

- Lenders process and verify such applications in no time as they don’t need to inquire about your credit report;

- You get the money funded within 24 hours.

Read more on no credit check installment loans on Compacom – one of the leading financial online platforms on the USA market.

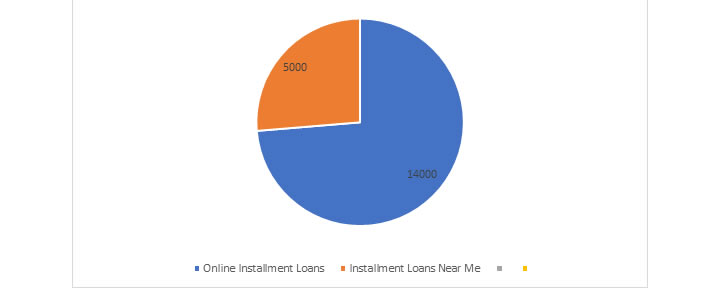

Installment Loans Online vs Installment Loans Near Me

Having analyzed the popularity of these two types of installment loans by Ahrefs search volume we can show the results in the diagram below:

Online borrowing is almost 3 times as popular as in-store one. It’s a natural result as all the services are much more accessible and convenient when you apply on the Internet.

You save time on driving and waiting in lines, and you don’t need to print or fax the documents. Just submit the application form online and get your money.

Loan approval and repayment are also done online which makes online installment loans even more attractive.

Summary

- Most Americans apply for Installment Loans Online.

- The majority use the money to cover education costs.

- Installment Loans are highly available for bad credit borrowers but interest rates can be rather expensive.

- Many applicants seek no credit check installment loans due to their speed, comfort, and guaranteed approval no matter what their credit score is.