Technologies such as Artificial Intelligence and Big Data have revolutionized medical practices. Moreover, discoveries such as stem cell therapy are paving the way forwards for treating diseases such as cancer and Parkinson’s. Nevertheless, manufacturing capabilities for biotechnology and pharmaceutical companies need to keep up. With record funding going into cell therapy, according to the Alliance for Regenerative Medicine, the question is now whether the CDMO sector can match the demand.

Comparing CRO and CDMO

The biopharmaceutical industry is worth $7.15 trillion, according to Statista. Moreover, it’s a complex industry with regulatory challenges that impact the delivery of drugs to the market. In addition, 2020 saw one of its biggest challenges ever with the global pandemic.

This means that the biotech and pharma industry suddenly had to turn around drug development and manufacturing, which they did in a record 9 months. The question now is whether the industry keeps this as the norm? Furthermore, what does this mean for CRO and CDMO companies? Let’s first have a look at some definitions along with some of their challenges:

- Stage of development

- Manufacturing capacity issues

- Partnerships

Stage of Development

Essentially, a CRO is a Contract Research Organization that deals with the first two stages of drug delivery known as drug discovery and drug development. Then, typically, a CDMO, or Contract Development and Manufacturing Organization, takes over at stage three in order to cover drug manufacturing. Sometimes a CDMO will also partner with a CRO to help them with the drug development phase, making the whole process seamless.

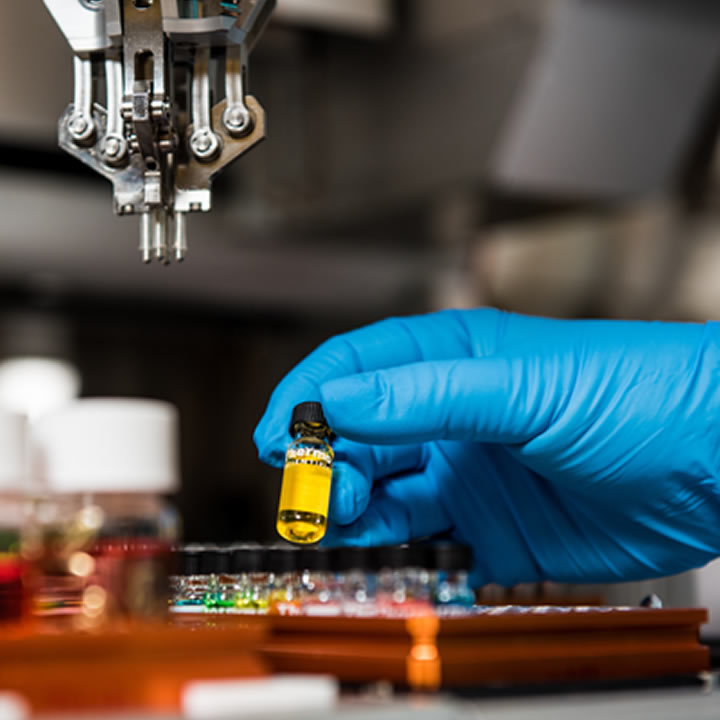

Whilst research and drug development is tough and takes time, the manufacturing process also has its challenges. A CDMO has to cope with everything from cell extraction, synthesis, and fermentation to formulation, commercial production, and packaging.

Manufacturing Issues

A company needs capital in order to set up manufacturing facilities for biopharmaceutical products. Funding is always a challenge especially when facing the rapid development rates for cell therapy, for instance. For this, a CDMO also needs to allow for future expansion such that it can easily scale up. To date, these requirements have slowed down product delivery although it has encouraged partnerships and acquisitions within the industry.

It’s worth noting that the CDMO market is growing quickly due to the greater need for global access to health. Another impact has been increased outsourcing from pharmaceutical companies so that they can save on costs and decrease their time to market.

The Future of CDMO

If you’re currently operating a CDMO, you might be wondering where to next? Being acquired comes with its own set of challenges but perhaps there are ways to stay competitive and relevant for the industry.

- Digital Technology

- Research and production

- Develop talent and expertise

Digital Technology

This is clearly a high growth sector with some CDMO companies boasting annual growth of around 25%. One way to stay competitive and cope with the massive scale-up requirements though is to stay on top of digital technology for automation. This could help you get more out of your process with fewer resources.

Research and production

Clearly, not all new technologies are worth the capital required to adopt them into practice. Therefore, keep in mind your overall business goals and strategy so that you can prioritize accordingly. For example, should your production process be faster or more efficient upstream versus downstream? Moreover, analytics and process data can help you focus on the problem areas such that you invest in the right technologies to support those areas.

Develop talent and expertise

Your CDMO business could have the best strategy in the world. Regardless, if you don’t have the right people to implement it then your business will most likely stagnate. You’ll then become a potential acquisition target for larger biopharmaceutical companies. Furthermore, what can you learn about the pandemic and how your team adapted accordingly?

Final Thoughts on CDMO and the Biopharmaceutical Field

Competition is always tough and this is especially true for smaller CDMO companies that might not have the capital behind them. By being smaller, you can focus on your niche whilst attracting skilled people. Then again, you can also take matters into your own hands and keep an eye out for strategic partnerships for vertical integration. This could be the differentiating factor for you to scale up and keep your competitive advantage. Whatever you decide, stay nimble and on top of the sector as it continues to evolve and adapt.