Potential clients are identified and sent mail by many business enterprises with the idea of doing business with ideal customers. Some companies are in the business of lending and send such mails with offers to handpicked clients. Getmyoffer Capital One is a lender who mail Pre-qualified credit card offers to such clients whom they consider potential.

The chances of you have received such a mail in the past are there. The bigger question is on how you respond to such an offer made by Capital one?

We attempt to arrive at the answer to this question and the ensuing ones in the passage below.

What are Pre-qualified credit cards?

Credit history is maintained by the authorities, which throws light on your financial status. The document would display your loans and how much has been the repayment, and whether there have been defaults or delays. Then points are allocated based on the report, and in case it is perfect, the rating is high.

The credit card companies can access this from the credit bureau and decide that you are a potential customer due to your high rating. If the company does not have access to such confidential information, they request the bureau to give them the report.

The customers who qualify are the people who have scored above the benchmark. Mails are sent to these people, and thus, the pre-qualified customers are chosen. With the offer mail-in hand, one can choose to respond in a way he wants to.

Why credit card offers come to me by mail?

It is not that you are the only one who is getting such offers on mail. Many who are rated as potential customers with a high credit rating are also beneficiaries of this. The fact is that lenders have to do business with such customers as you. The offer may come from various such companies, and the lenders try to preempt you by making you their customer. In this process, there would be an extraordinary amount of bonuses offered, which would swing your decision..

There are chances that you may get these offers even if your credit rating is far below the benchmark. It is only wise to accept such an offer as it is your good luck shining through.

The pre-qualified offer can be initiated by you too. In this scenario, you would have applied to Capital One through their website and enclosed all desired information on both fronts; both rersonal and financial. Getmyoffer.Capitalone.com Capital One sends this financial information to the credit bureau for analysis and simultaneously engage in a background check.

There are three vital pieces of information that you should share with Capital one, and those are, your name, domicile address, and social security number. Once this is done, all you have to do is wait for the mail with offers intact.

Response to Capital One offer:

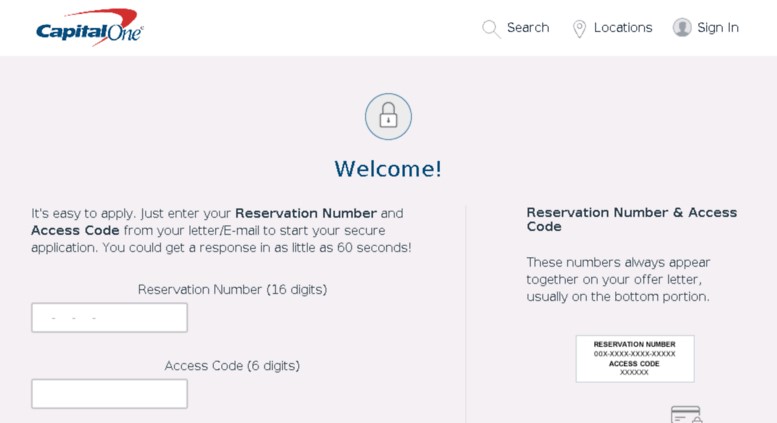

- In the event, the offer mail has arrived, you would observe a reservation number and an access code.

- Access the website of Capital One and search for the credit card section.

- In it, you would find ” Respond to a mail offer’ and click on it.

- You would see a 16 digit field, in which the reservation number should be entered.

- Now enter the access code, which is six digits.

- You would be directed to a page where you can start initiating the process of application.

- In case you have not received the Pre-qualified offer codes, it would take you less than a minute to enter your details and access both the codes.

Stopping credit card letters of pre-approval.

Some people do not like receiving such offers through mail except people who have a low credit rating. To stop the mail, please follow one of the options below :

- Call 1-888-5-OPT- OUT which is 1-888-567-8688 or

- Open website ‘ optoutprescreen.com ‘and deliver your intention.

These happen to be the Credit bureau contact details, and once they receive your request, they would block your details from anyone accessing it, and the mails would also cease to arrive for five years.

Conclusion:

A credit card is a useful financial tool, especially in times of emergencies. It would not be advisable to decline it in haste nor get attracted by all the offers. The best policy would be to define the parameters yourself and utilize it wisely.